Business

Minerals Income and Investment Fund (MIIF) gets Acting CEO

The President, His Excellency John Dramani Mahama, has in accordance with Article 195(1) of the Constitution and Section 21(2) of the Minerals Income and Investment Fund

(MIIf) Act, 2018 (Act 978), appointed Ms. Justina Nelson as the Acting Chief Executive Officer of the Minerals Income and Investment Fund,

This follows the revokation of the appointment of the former CEO, Edward Nana Yaw Koranteng yesterday, January 14, 2025.

Ms. Nelson is an accomplished Banking Professional with over twenty years experience.

She is currently a Group Head at Zenith Bank (Ghana) Limited with oversight responsibility for both the Energy and Commercial Banking sectors.

Ms. Nelson holds a Master of Laws in Corporate and Commercial law and a Master in Business Administration (Marketing) both from the University of Ghana.

She also holds a Bachelor of Laws (Hons) degree from the Ghana Institute of Management and Public Administration (GIMPA) and a Bachelor of Arts (Hons) degree in Management

and Psychology from the University of Ghana.

By Edem Mensah-Tsotorme

Business

Sammi Awuku backs former Finance Minister

Former National Lotteries Authority Boss Sammi Awuku has backed the former Finance Minister’s claim on Betting Tax

The former Finance Minister, Dr.Amin Adam, after the 2025 budget said the NPP did not implement any betting tax.

Additionally, he noted that for the NDC government to say they have abolished something which did not exist was unconscionable.

The former minister has come under fierce criticism on social media by some Ghanaians who believed the betting tax existed.

In a post backing the former Finance Minister, Mr.Awuku wrote.

Read the full post below;

On the So-Called Abolition of 10% Tax on Lottery Wins….

First off, It is important to clarify that lottery is different from betting and same as its taxes. The National Lottery Authority (NLA) is under the Ministry of Finance, while betting is regulated by the Gaming Commission under the Ministry of the Interior.

This distinction matters, yet it’s often ignored for political convenience.

After listening to today’s budget presentation by the Finance Minister , I couldn’t help but notice a rather misleading claim that the government has abolished the 10% lottery tax on winnings.

But let’s be honest: how do you abolish a tax that was never implemented?

For the record, under the previous NPP administration, we engaged extensively with stakeholders, including the then Finance Minister and Hon. Amin Adam and the GRA after the announcement of the proposed 10% tax on lottery wins and recognized early on that taxing lottery winnings would be problematic.

It would have been difficult to administer, cripple the Lottery sector, unfair to players and ultimately more harmful than beneficial.

That is why the tax was never implemented nor enforced.

So, let’s call it what it is. This isn’t an “abolition” but rather a convenient attempt to score political points.

The truth is, the NPP government had already made the decision not to burden Ghanaians with this lottery tax because we understood its impact.

Hon. Amin Adam won’t be wrong to say the Betting tax was never collected anyway since the Finance Minister Hon. Ato Forson also referred to the 10% on Lottery wins as “Betting Tax”. So if that’s what the Finance Minister refers to as Betting Tax then it was never implemented even though passed in 2023.

Ghanaians deserve honesty, not spin. Policies should be about real impact, not just headlines. Let’s focus on the issues that truly affect livelihoods.

Business

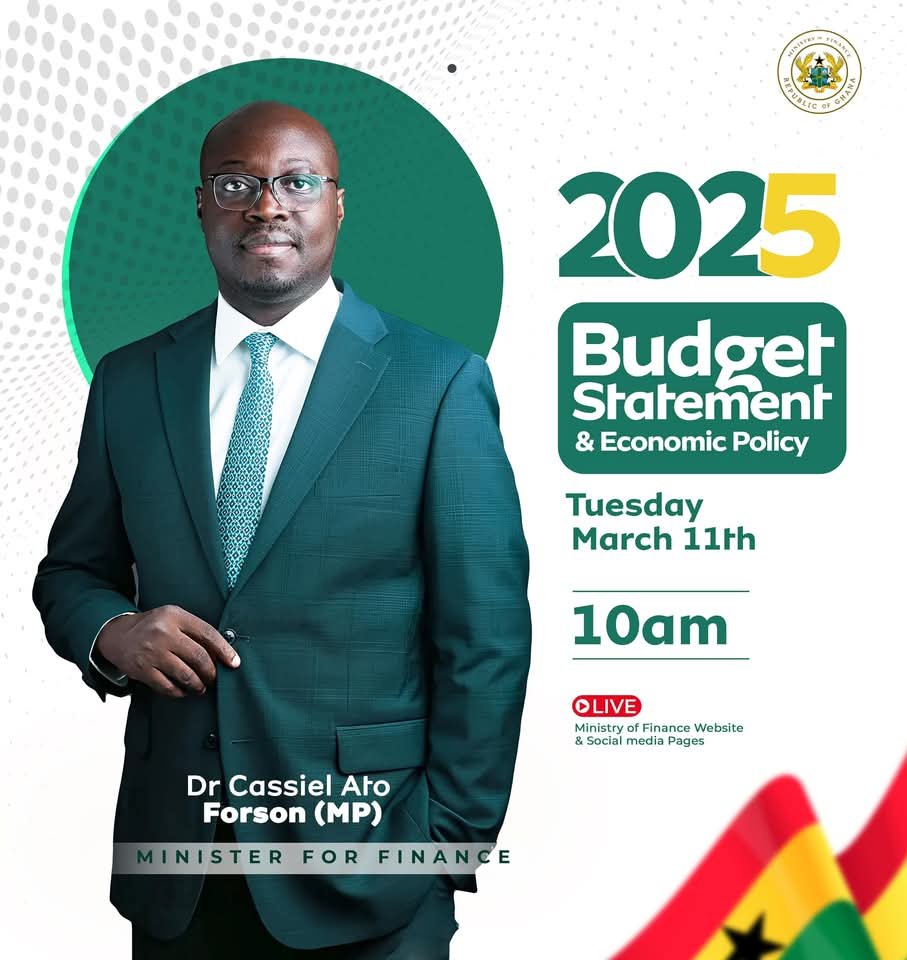

Finance Minister to present budget today

All is set for the presentation of Ghana’s budget statement and economic policy by the Finance Minister, Cassiel Ato Forson to Parliament today.

This would be the new government’s maiden budget since ascending to the throne in January.

Ghanaians are highly optimistic that the budget would go a long way to cushion people.

They are expecting that the National Democratic Congress (NDC) government will keep it promise and remove the E-levy, Betting Tax, and COVID-19 levy among other tax cuts.

Additional, it is expected that some measures will be introduced to stabilise the local currency and some prudent ways to ensure food security to reduce food inflation.

Ahead of that the Finance Minister has organised national economic dialogue, engageg over 60,000 youths on X, and market women among others to seek their views.

By Edem Mensah-Tsotorme